Award-winning PDF software

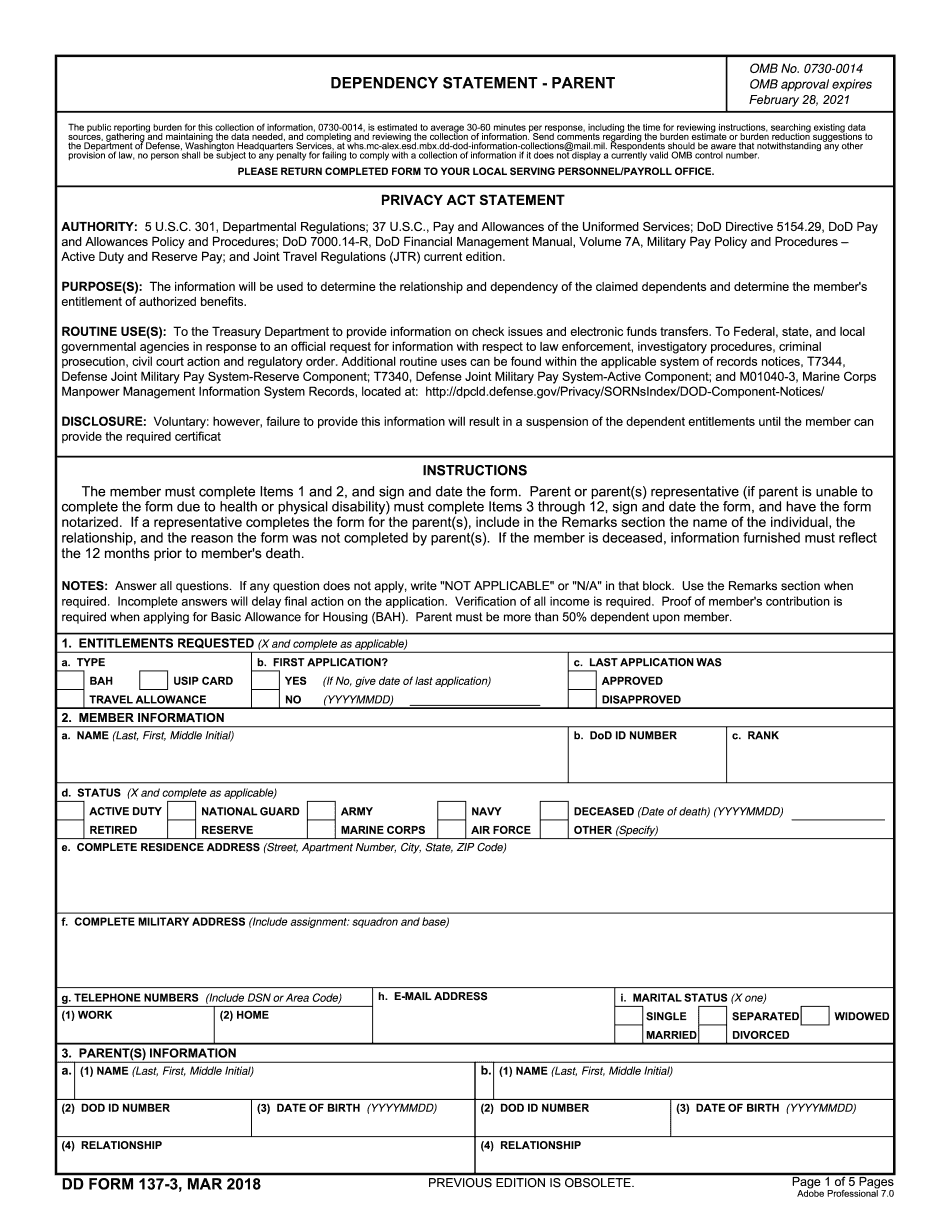

dd form 137-3, "dependency statement- parent" - washington

Form 137-3 is derived by calculating the number of tax filers of each type according to whether they are primary or dependent filing status, and adjusting such filers for age, filing status, marital status, and filing status of other household members. This is different from the primary filing tax form which does not determine filers' filing status but identifies whether they are primary or dependent filers. The primary filing status form is discussed below in the discussion regarding the secondary reporting form of Form 5329 for certain spouses or domestic relations orders of support. For purposes of this . Form 137-3, if filers are not primary or dependent filing status, they are considered to be other households by the Department. For more information on this filing form and other forms that are required for purposes of this . Form 133, see IRM, Required Forms for Filing Claims in Connection with Covered.

dd form 137-7, "dependency statement - ward of a court"

Amount of Housing Allowance Available MISSING: 1371 MISSING: 1373 | Must include: 1373 MISSING: 1369 | Must include: 1369 MISSING: 1367 | Must include: 1367 MISSING: 1359 | Must include: 1359 MISSING: 1347 | Must include: 1347 For an individual who is not a member of the Armed Forces under the Uniform Code of Military Justice, if you are listed on the Uniformed Services Identification Card, the Basic Allowance for Housing (BAH) will reflect your basic monthly payment under FHA rules. Additional BAH information MISSING: 1358 | Must include: 1358 MISSING: 1356 | Must include: 1356 MISSING: 1360 | Must include: 1360 MISSING: 1377 | Must include: 1377 Maintain BAH data on the Web if applicable.

Defense finance and accounting service

USDA/APHID Dec 3, 2020 Forms: DD Form 137-6. A medical sufficiency letter signed by a United States Department of Agriculture (USDA) or Applied Animal Health (AAH) personnel is required. Dec 7, 2020 Forms: DD Form 137-17. A medical sufficiency letter signed by a United States Department of Veterans Affairs (VA) personnel is required. Department of Defense June 1, 2024 Forms: DD Form 137-18, DD Form 137-19, DD Form 137-20, and DD Form 137-21. Dec 31, 2028 Forms: DD Form 137-22 and any subsequent versions. The DD Forms 137-22, 139, and 141 were not affected by FDA's new regulations. United States Citizenship and Immigration Services Jan 1, 2025 Forms: DD Form 137-23. A medical sufficiency letter signed by an immigration officer is required. No person listed as a dependent on a green card application is required to take part in the biometric assessment. Dec 31, 2019 Forms: DD Form.

dd form 137-3, dependency statement - parent, february 2016

Sign the form (see item 3 above) at the same time. They are the sole responsibility of the family member who has been invited to make this purchase. Children of legal age must be at least two years of age or older at the time of purchasing to receive a rebate. (The child must be accompanied by a parent/legal guardian). Members must use their own funds by means of debit card or credit card to complete purchase. If the member has trouble completing the purchase on his/her debit card, the member must call Customer Support (toll-free at). REBATE WILL NOT BE ISSUED BY THE LABOR RELATED PARTY OR ANY OTHER PERSON OR PARTY RECEIVING ANY REWARD. The laborer may refuse an offer but must provide proof of identity and residency within the United States. Reimbursement will be made only when payment is in the form of cash or check. REBATE.

Dd form 137-3: dependency statement | free pdf sample

As a matter of form, the following instructions will be the standard instructions. The dependent children must report on this form all dependent family income, as well as any child tax credit, earned income credit, non-earned income credit, or child care credit the parents have claimed for their children in prior years. The dependent children must file their own income tax returns and itemize deductions. Their income for the year must be less than the total income the parents claimed for their children in prior years. There are exceptions to this rule. The dependent children do not require to file another Form 1040 to report their income for a year. And no children who did not live with a spouse at any time during the year under the parents' joint return must file for that year unless they also file separately. See Dependent children who don't file for other dependents. The dependent.